Here are some examples of the types of invoices you might receive regarding your policy. In these examples, we illustrate the most significant parts of each invoice. If you have any questions about your invoice that aren’t answered here, please call us at (888) 782-8338.

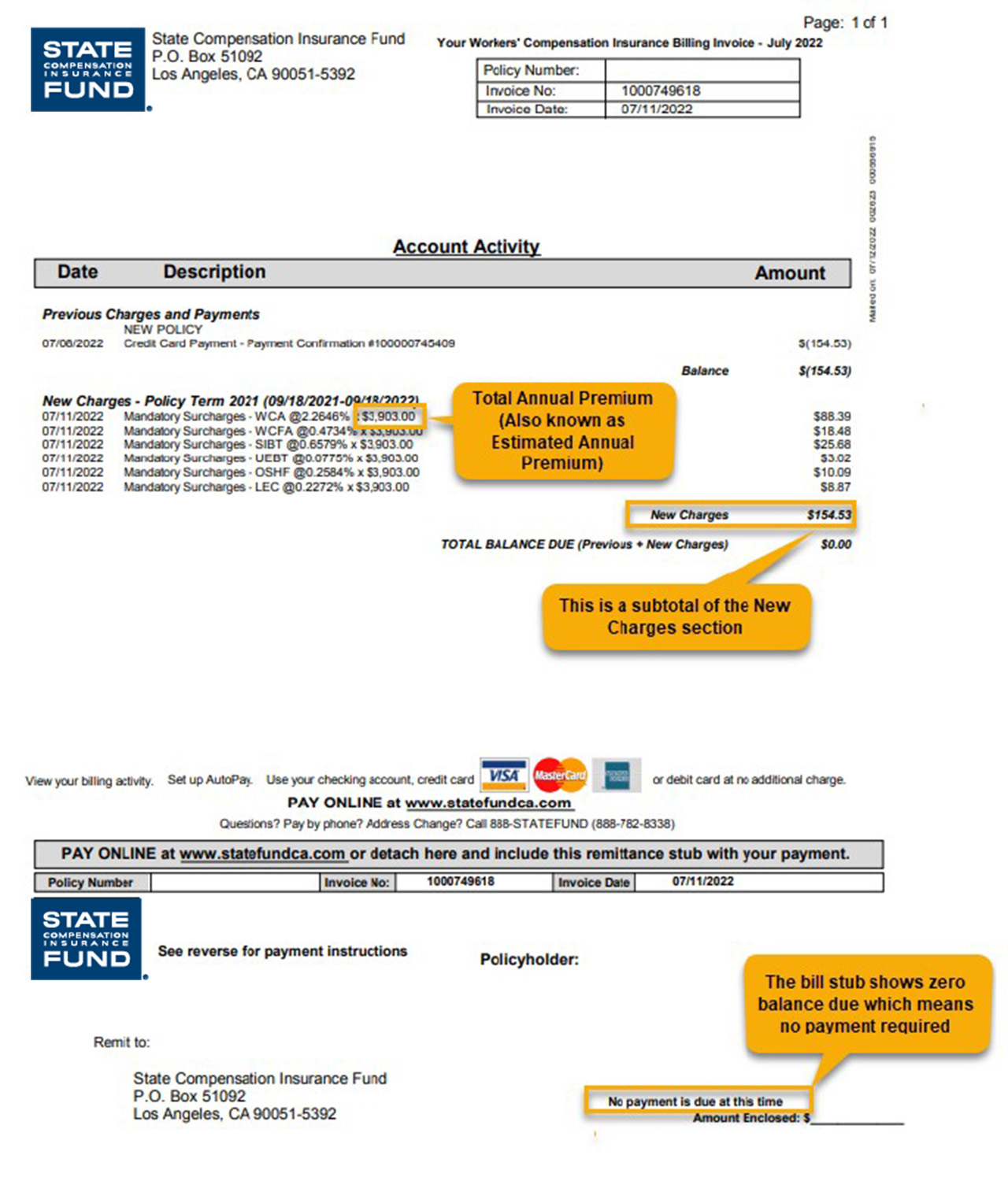

This first example is for a new policy that you may have received after you bound with us. It shows your payment to bind the policy as well as a series of legally required surcharges that any workers’ compensation policy in California must have added to the cost of a policy.

[Top]

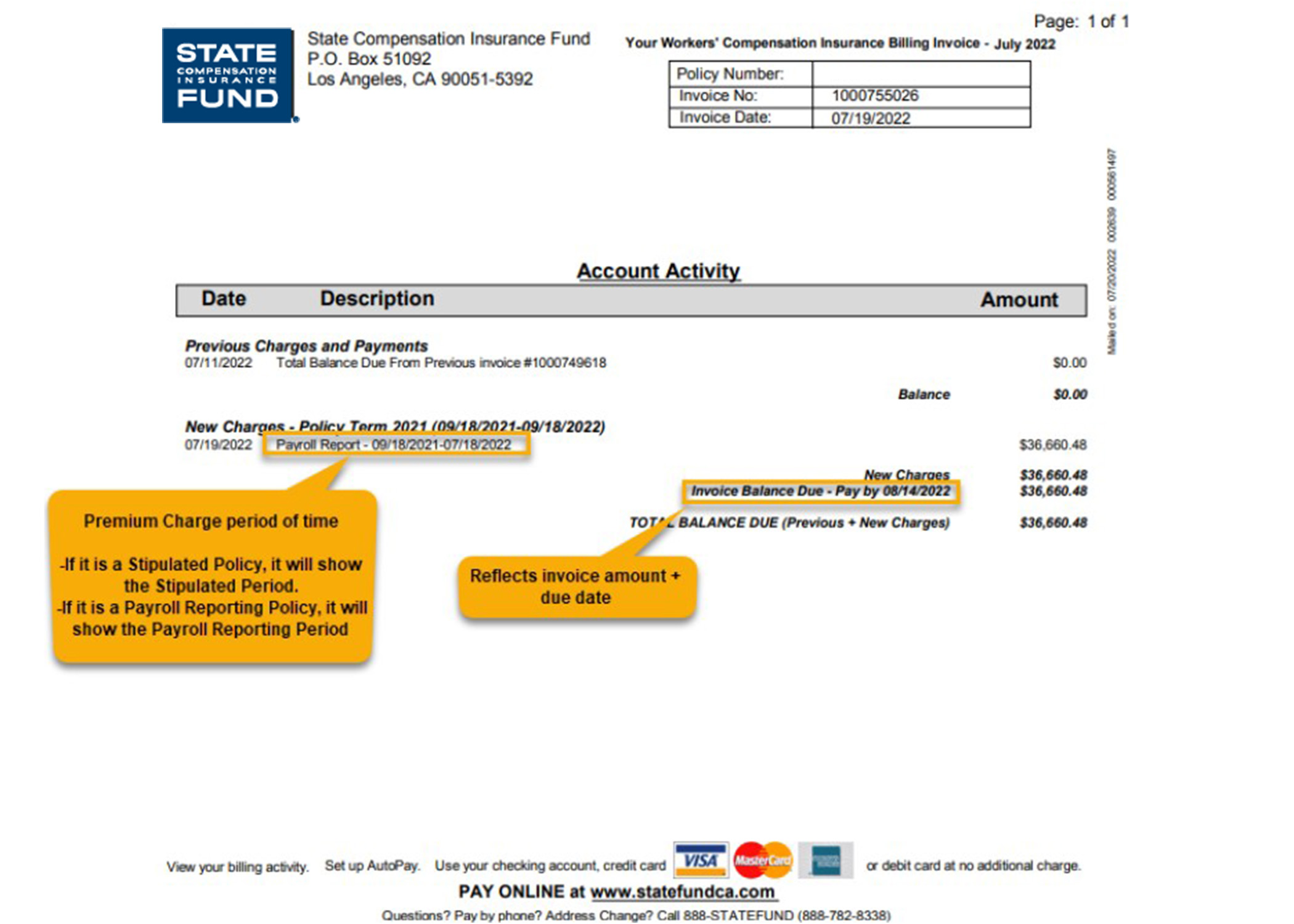

Standard InvoiceThis next invoice shows the payroll you’ve reported and the payroll reporting period type your policy has. It also includes previous charges and payments. The calculation of past payments and current charges will show what you owe to keep your policy in good standing.

[Top]

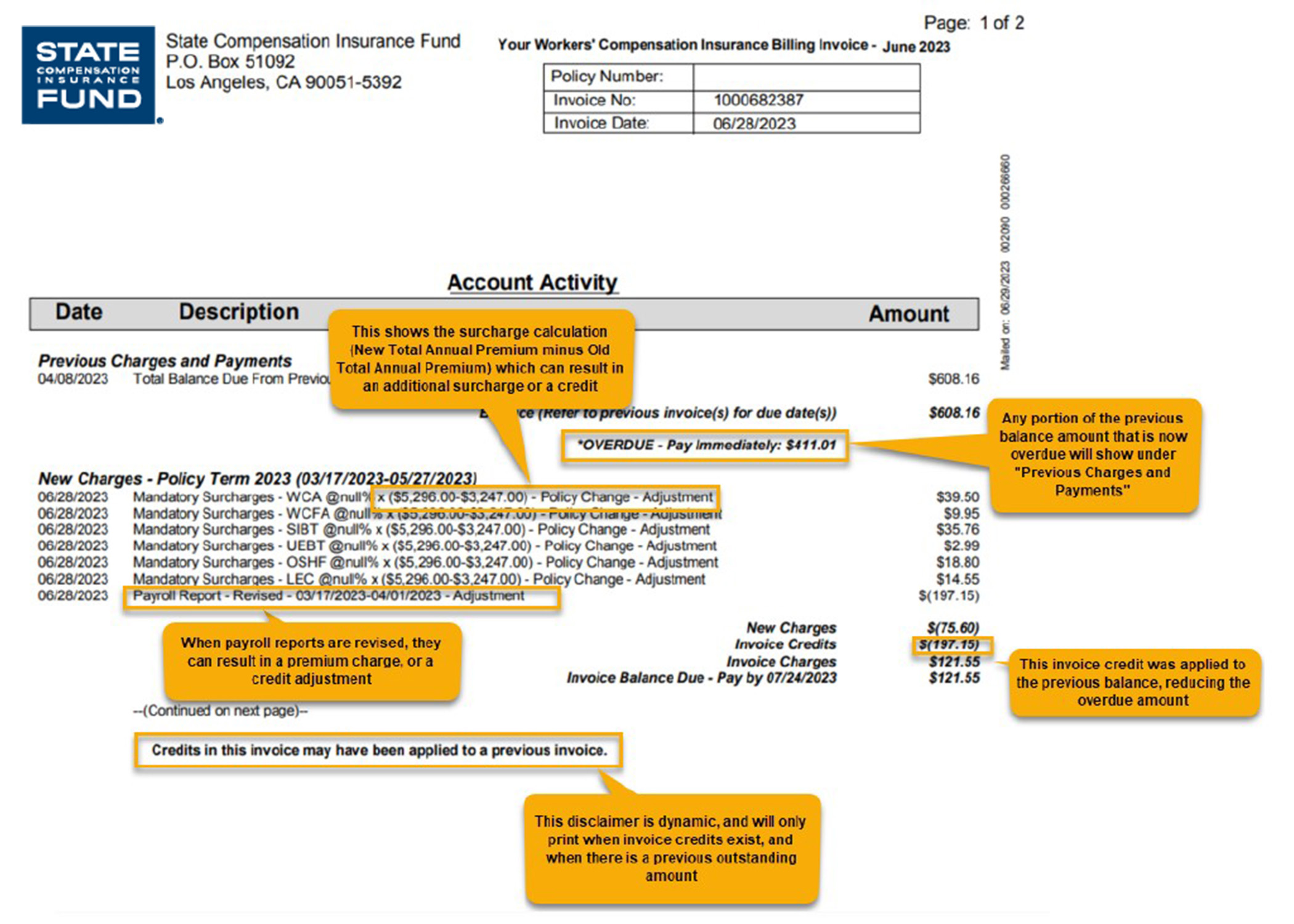

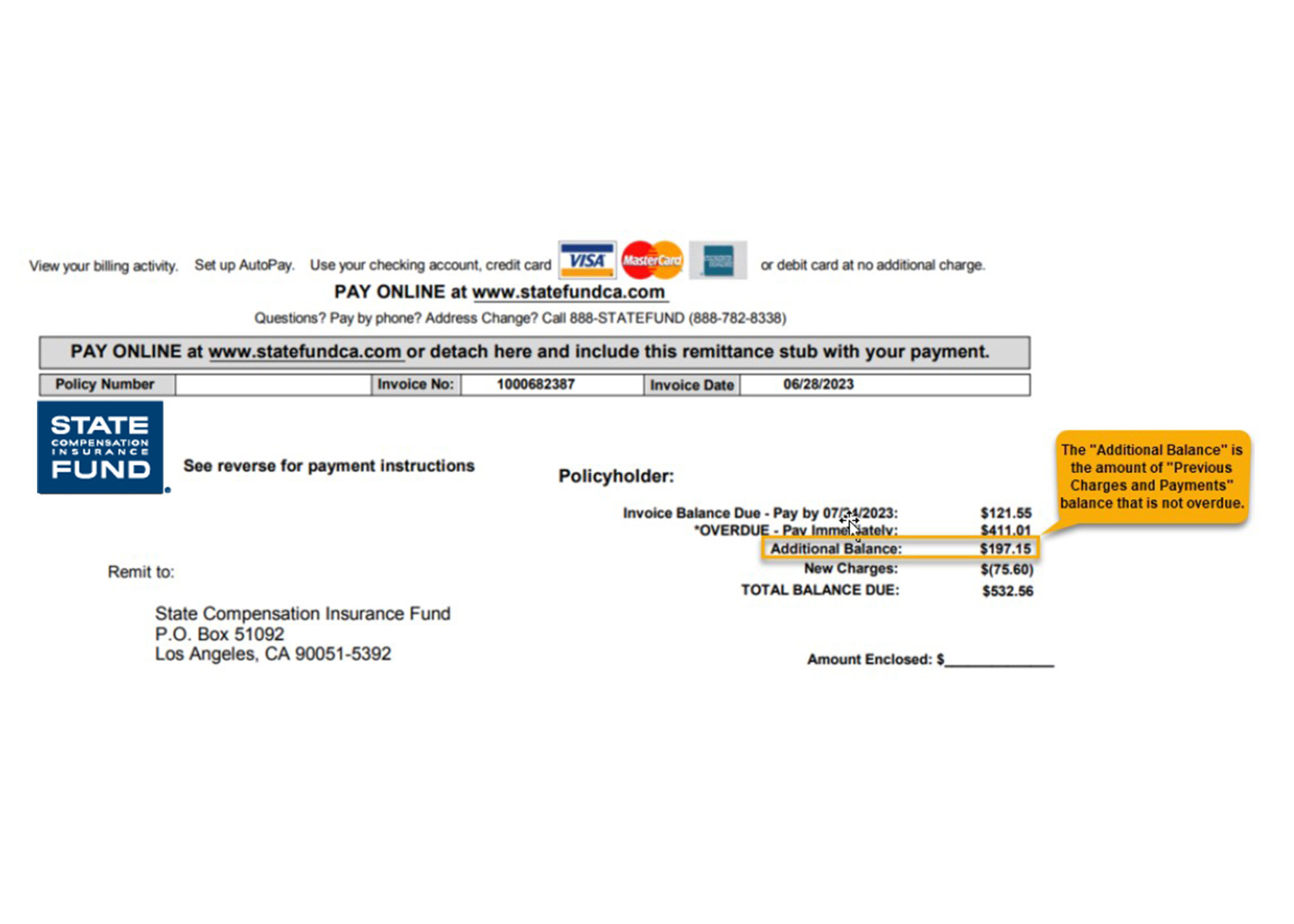

Overdue PaymentThe next item shows what your invoice will look like if you have an overdue payment and a premium rate change based on changes in your payroll. Like the last example, it includes a calculation of past credits and current charges, with a total listed at the bottom for any payments due.

[Top]

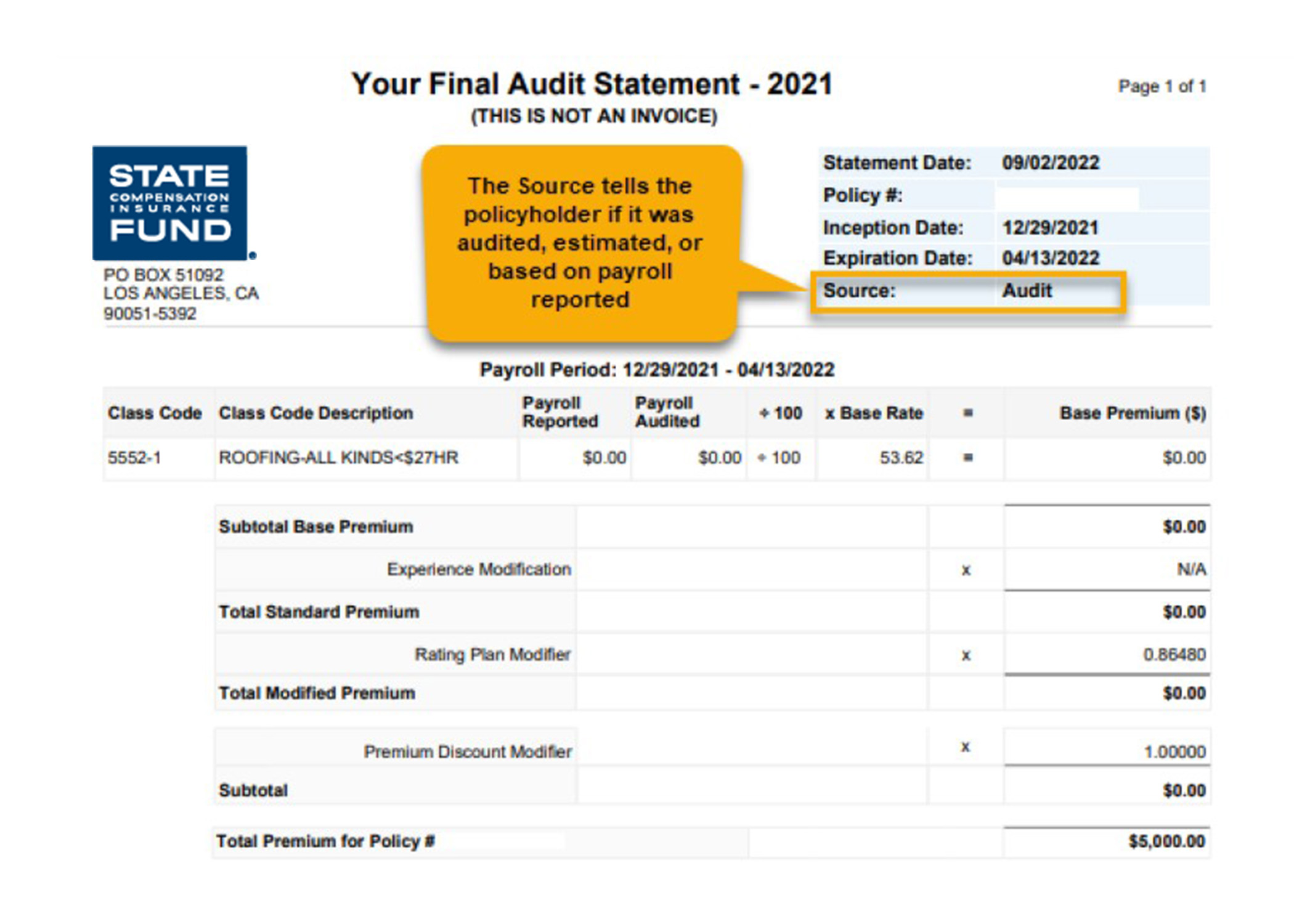

Final Audit StatementLast is the final audit statement for the policy term, which includes information from a policy audit, if there was one. This isn’t an invoice for payment, but an explanation of the charges you will receive based on the total payroll for the policy year. If premium is owed, you’ll receive another invoice for payment.

[Top]